Updated daily, InsiderOnline (insideronline.org) is a compilation of publication abstracts, how-to essays, events, news, and analysis from around the conservative movement. The current edition of The INSIDER quarterly magazine is also on the site.

July 6, 2012

Latest Studies: 35 new items, including a report from Istituto Bruno Leoni on the failure of Europe’s emissions trading system, and an E-21 report explaining why the SCOTUS ruling on Medicaid might collapse the program’s finances

Notes on the Week: The jobs report is bad again, ObamaCare already had a lot of taxes, what if progressives could rewrite the Declaration of Independence? and more

To Do: Summer reading, filmmaker school, interns debate

Toolkit: Don’t just throw your literature on a table; use your exhibit booth to engage people!

Budget & Taxation

• A Fiscal History Lesson – Hoover Institution

• Taxing Sales: Comparing the Origin-Based and Destination-Based Models – Hudson Institute

• Does Colorado Fail to Spend State Taxes on Services? – Independence Institute

• One Way Street for Spending Adjustments: Reverse Logrolling Offers an Alternative – John Locke Foundation

Economic Growth

• The End of Stimulus Policy – American Enterprise Institute

• The 4% Solution: Unleashing the Economic Growth America Needs – Crown Publishing Group

• White House Retort to Fed Study Comical Given Previous Class Rhetoric – Economics 21

• The Resilience of Arab Monarchy – Hoover Institution

• Using Staffing Companies to Reduce Unemployment – National Center for Policy Analysis

• The Fortunate 400 – Tax Foundation

Education

• Unequal Access: Hidden Barriers to Achieving Both Quality and Profit in Early Care and Education – American Enterprise Institute

• A New Type of Ed School – Education Next

• Using Value-Added Analysis to Raise Student Achievement in Wisconsin – Wisconsin Policy Research Institute

Family, Culture & Community

• Fertility Decline in the Muslim World – Hoover Institution

Foreign Policy/International Affairs

• U.S. Should Respect Paraguay’s Decision to Remove President Lugo – The Heritage Foundation

• An Islamist Middle East? – Hoover Institution

• The Many Faces of Islamist Politicking – Hoover Institution

Health Care

• The Healthcare Myths We Must Confront – American Enterprise Institute

• Did the Supreme Court Ruling Render the Health Law’s Finances Untenable? – Economics 21

• Leaving Canada for Medical Care 2011 – Fraser Institute

• Opportunity for Health Reform: Lessons From Switzerland – Fraser Institute

• A Taste of Government-Run Healthcare – Hoover Institution

• Reshaping Global Health – Hoover Institution

• Is There a Health-Care Problem in Western Societies? – Independent Institute

• User Fees for Medical Devices: Third Time Lucky? – Pacific Research Institute

• A Silver Lining: The Supreme Court’s Ruling on ObamaCare’s Medicaid Expansion – Texas Public Policy Foundation

Immigration

• Scalia’s Wise Dissent – American Enterprise Institute

International Trade/Finance

• Mandatory Country of Origin Labeling: The Case for Harmonized Canada-US Beef and Pork Regulatory Regime – Fraser Institute

Natural Resources, Energy, Environment, & Science

• Attack of the Scare Ads! – Capital Research Center

• Is the ETS Still the Best Option? – Istituto Bruno Leoni

Regulation & Deregulation

• Ending ‘Big Sis’ (The Special Interest State) and Renewing the American Republic – James V. DeLong

The Constitution/Civil Liberties

• Forty Years of Originalism – Hoover Institution

• Competitive Federalism: Leveraging the Constitution to Strengthen Oklahoma – Oklahoma Council of Public Affairs

Transportation/Infrastructure

• Transportation Conference Bill: Some Good Reforms, but Too Much Spending – The Heritage Foundation

• Autonomy – Manhattan Institute

Higher Ed Is the Next Bubble: The government continues to do the same things to higher education that it did to housing, which means we’re in for another crisis, explains Anthony Davies:

For and Against: The federal government is both attacking and subsidizing the consumption of soda. Lachlan Markay [The Foundry, July 2] points out that the 2012 farm bill, passed last week, “preserve[s] tariffs on the importation of sugar and domestic quotas that keep prices artificially high” while food stamps may still be spent on sugary drinks. Yet:

In New York City, which is looking to ban soft drinks larger than 16 oz., the federal government has financed 87% of a $2.8 million ad campaign linking soda to obesity, according to a Sunday report in the New York Times.

This example of schizophrenic policy reminds us of Ronald Reagan’s quip: “Government’s view of the economy could be summed up in a few short phrases: If it moves, tax it. If it keeps moving, regulate it. And if it stops moving, subsidize it.”

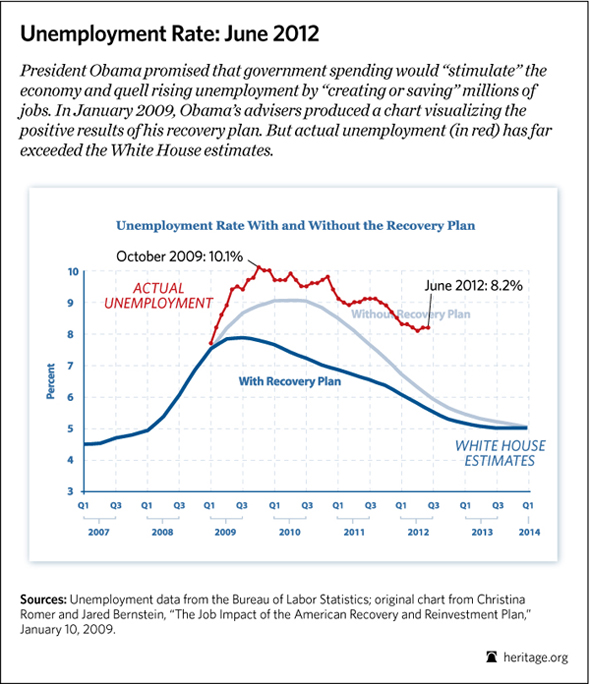

Breaking News from Every Month for the Last 36 Months: The employment picture still lags the promises made for President Obama’s stimulus plan:

What Part of “No Law” Do They Not Understand? Somehow, governments across the country have come to believe that sign codes are a kind of First Amendment loophole. How did that happen? The Institute for Justice, which is hard at work challenging this trend, explains in this video:

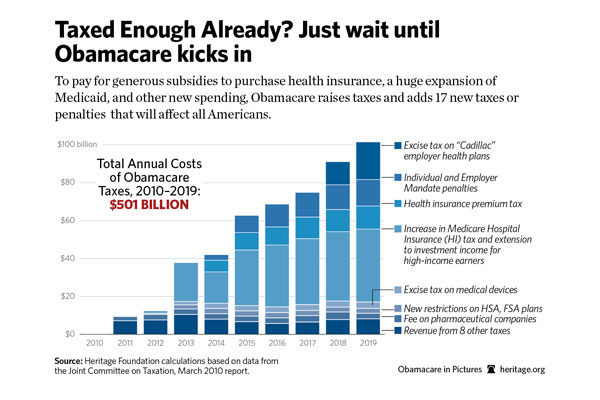

The ObamaCare Taxes Ahead: And these are just the ones the law refers to as taxes:

Gun Rights Group Schools Chicago on Gun-Buy Back Program: Who turns in their guns when cities offer to buy them back? Turns out, it’s pretty much the same people who abide by gun laws—the non-criminally-inclined. But, as Franklin Main [Chicago Sun-Times, June 30] reports, Chicago took notice of one particular law-abiding group at its recent buy-back event:

The city collected 5,500 guns last Saturday in the annual buyback. The city gave out $100 MasterCard gift cards for each gun and $10 cards for BB guns and replicas.

Sixty of the guns and several BB guns were turned in by the Champaign-based Guns Save Life. In return, the group received $6,240 in gift cards, said John Boch, president of the group. […]

Most of the money will go toward buying ammunition for an NRA youth camp in Bloomington. The rest will pay for four bolt-action rifles that will be given away to campers.

“This was rusty, non-firing junk that we turned in,” Boch said. “We are redirecting funds from people who would work against the private ownership of firearms to help introduce the next generation to shooting safely and responsibly.”

The police were not happy:

“We host the gun turn-in event on an annual basis to encourage residents to turn in their guns so we can take guns off the street and it’s unfortunate that this group is abusing a program intended to increase the safety of our communities,” said Melissa Stratton, a police spokeswoman.

Actually, the incentives for “abuse” (the city’s word) are there for anybody who turns a gun in; the city just didn’t want to notice until an avowedly pro-gun rights group started doing it. As Eugene Volokh [Volokh Conspiracy, July 2] points out, if the police thought they were going to get guns worth more than $100 by offering $100, then they need some economics lessons.

That Regulation and Taxation Are Close Substitutes Is Not a New Problem: As you probably know by now, last week Chief Justice John Roberts rejected the government’s expansive theory of its Commerce Clause powers only to give ObamaCare a thumbs up under Congress’s tax power. Richard Epstein [New York Times, June 28] points out that this case wasn’t the first time the Supreme Court had been asked to consider the use of the tax power for regulatory purposes:

In the Child Labor Tax case of 1922, the Supreme Court refused to uphold a tax equal to 10 percent of the net profits of any firm that shipped goods into interstate commerce if the firm used child labor anywhere in its plants. Chief Justice William Howard Taft noted that the court’s earlier decision in Hammer v. Dagenhart (1918) forbade Congress to use its commerce power to prohibit outright the shipment of ordinary goods across state lines because they were made in factories that used child labor. A heavy tax, the court argued, could not be used to mount an end run around this constitutional obstacle to its own power.

The same point was reinforced in 1936 in United States v. Butler, which struck down a tax on agricultural commodities because it sought to achieve the then unconstitutional regulatory aim of reducing the total acreage in agricultural production. After the 1942 case Wickard v. Filburn, when the Commerce Clause was held to permit such regulation, the tax became just as permissible as direct regulation. Wickard expanded the scope of federal power, but it did nothing to upset the constitutional parity between the taxing and commerce powers.

So these limits on the tax power survived the New Deal—only to be upended by Chief Justice Roberts.

Somebody’s Been Talking Too Much: A rundown of the national security leaks of the past year, from the American Enterprise Institute:

What If Progressives Could Update the Declaration of Independence? Walter Russell Mead imagines how it might go:

The unanimous Declaration of the Thirteen Post-Colonial, Multi-Racial Societes of North America

When in the Course of human events, it becomes necessary for one people to strengthen the political bands which have connected them with the Global Community, and to assume among the powers of the earth, the cooperative and deferential station which a careful review of the relevant peer reviewed literature suggests is most appropriate for long term win-win outcomes, a decent and rigorously equal respect to the opinions of woman- and man- and transkind requires that they should declare the causes which impel them to the ever deeper union.

The rest of the rewrite is available at Via Media, July 3. The forces of political correctness have already messed with Mark Twain, so maybe a non-satirical rewrite of the Declaration isn’t too far off. On the other hand, why bother? Progressives have already shown that they can rewrite the Constitution as practiced without actually altering the text. [See, for example, Ronald Pestritto, “The Birth of the Administrative State: Where It Came From and What It Means for Limited Government,” The Heritage Foundation, November 20, 2007; and Richard A. Epstein, How Progressives Rewrote the Constitution, Cato Institute, 2006.]

ObamaCare Has Another Legal Problem: The Supreme Court has upheld the Individual Mandate, but the law’s subsidy scheme won’t work unless the Internal Revenue Service gets away with imposing a tax not authorized by the law. Jonathan Adler and Michael Cannon [USA Today, June 25] explain:

Under the guise of implementing the law, the Internal Revenue Service has announced it will impose a tax of up to $3,000 per worker on employers whom Congress has not authorized a tax. […]

The Act’s “employer mandate” taxes employers up to $3,000 per employee if they fail to offer required health benefits. But that tax kicks in only if their employees receive tax credits or subsidies to purchase a health plan through a state-run insurance “exchange.”

This 2,000-page law is complex. But in one respect the statute is clear: Credits are available only in states that create an exchange themselves. The federal government might create exchanges in states that decline, but it cannot offer credits through its own exchanges. And where there can be no credits, there is nothing to trigger that $3,000 tax.

In other words, unless the courts let the IRS ignore the law, states have it in their power to make the law’s subsidy scheme unworkable by refusing to create exchanges.

• Stock up on summer reading. For ideas, consult National Review’s and the Mercatus Center’s summer reading lists. The Mercatus list is heavy on serious works of political economy, but there are some surprising choices as well. (Bill James Baseball Abstract! Well, maybe it’s not so suprising that policy geeks like baseball stats.) The National Review list provides more choices in history, fiction, and philosophy.

• Apply for the Atlas Foundation’s filmmaking training program for think tanks, Lights, Camera, Liberty. The program includes training with experienced filmmakers in Los Angeles and up to $5,000 in equipment. Apply by August 31.

• Find out which philosophy makes more sense, libertarianism or conservatism. And find out which think tank’s interns are better at making an argument for their respective institution’s philosophies. Heritage Foundation interns will square off against Cato Institute interns on July 18 at 6:30 p.m. at the Cato Institute.

• Learn how leftist critics have things exactly backward on the free market. At The Heritage Foundation, on July 12 at noon, Father Robert Sirico of the Acton Institute will talk about his new book Defending the Free Market: The Moral Case for a Free Economy.

Toolkit: Don’t Just Pile Your Literature on a Table—Use Your Exhibit Booth to Engage People!

Your organization can increase its outreach significantly by using best practices when exhibiting at conferences. The marketing company Marketech surveyed thousands of conference attendees to determine the most effective techniques at exhibit booths. Here are a few ideas:

• Choose energetic outgoing people to run your booth.

• Remove all chairs from behind your display table, to make sure your booth attendants are standing up and engaging as many passers-by as possible.

• Have a promotion, like a drawing for a Kindle Fire. That will significantly drive up the number of attendees who sign up for your newsletters and campaigns.

• Be selective in what you display. Make the literatures/product you choose to bring to the conference matches the interests of those who will be attending.

• Use short videos and product demonstrations to catch people attention.

Read Mike Thimmesh’s “White Paper: What Attendees Tell Us About Best Exhibiting Practices” to learn more about how to drive up make the best impact with your exhibit booth.

See our Toolkit at InsiderOnline.org for more helpful ideas.

Have a tip for InsiderOnline? Send us an e-mail at insider@heritage.org with "For Insider" in the subject line.

Follow us on Twitter: http://twitter.com/InsiderOnline.

Looking for an expert? Visit PolicyExperts.org.

The Heritage Foundation

214 Massachusetts Ave NE

Washington DC 20002-4999

ph 202.546.4400 | fax 202.546.8328

No comments:

Post a Comment